Is Dubai Real Estate a Bubble Waiting to be Burst?

- Hamza Alavi

- Dec 7, 2024

- 8 min read

Updated: Oct 29, 2025

The concept of a real estate bubble has been a topic of great debate and interest over the years, especially in cities where property prices have seen a dramatic rise. The number one question investors have been asking for over 20 years in Dubai is: When will this bubble burst?

Those who have truly understood the market during this period have more than doubled or even tripled their investment returns, while some early investors in exclusive projects have seen returns exceeding 300% in areas such as Palm Jumeirah. The Dubai real estate market is unlike any other in the world, offering an average rental yield of 6-8%, whereas other top cities typically see only 2-4%. Additionally, capital appreciation in Dubai averages 25-40% within just three years of your initial investment giving you the opportunity to maximize both rental returns as well as capital appreciation.

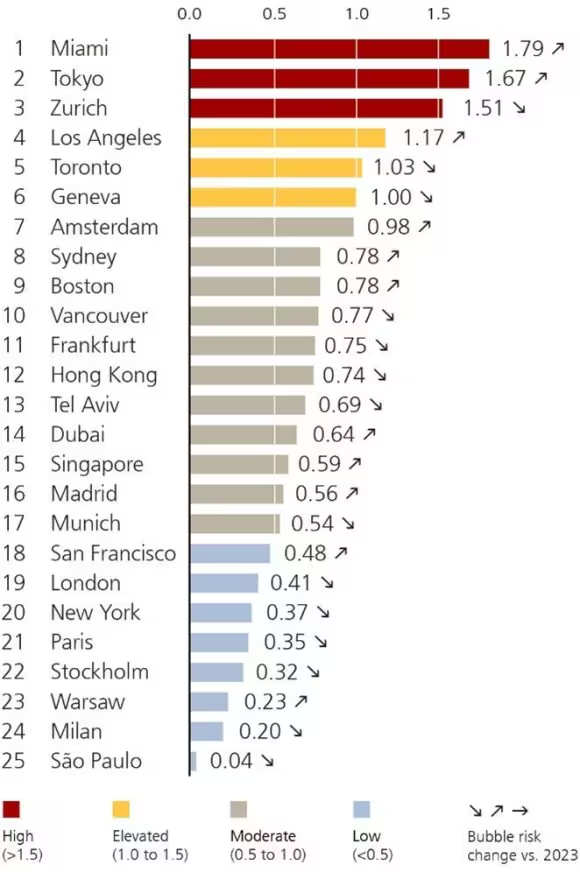

This article examines the UBS Global Real Estate Bubble Index Report, published by UBS Group AG, comparing Dubai's market to other global cities and exploring the implications of rising bubble risks, highlighting the factors contributing to market resilience and potential investment opportunities.

What is a Real Estate Bubble?

A real estate bubble occurs when property prices surge rapidly due to speculative demand, often leading to a sharp decline or a sudden crash when the market corrects itself. The risk of a bubble can be assessed using a Real Estate Bubble Index, which evaluates how over- or undervalued a market is.

Understanding the Real Estate Bubble Index

The Real Estate Bubble Index, developed by UBS Group AG, measures the risk of a Real Estate bubble in different markets by analyzing key factors such as:

Price-to-income ratio: This compares property prices to the average income of local residents to assess affordability.

Price-to-rent ratio: It evaluates property prices relative to the cost of renting similar properties, highlighting potential overvaluation.

Mortgage rates: The index considers loan affordability, examining how interest rates impact buyers' ability to finance homes.

Construction activity: It looks at whether there is overbuilding or a supply shortage, both of which can influence market stability.

Foreign investor demand: Markets with heavy foreign investment may see inflated property prices due to external demand, which can distort the market.

This index helps identify when property markets are overheated and at risk of a price correction.

Fun Fact: Did you know that Dubai is the only Middle Eastern city listed on the Bubble Index?

An index reading above 1.0 typically indicates a higher risk of a bubble, while readings closer to zero or negative suggest market stability or undervaluation as in case of Dubai.

Dubai’s Real Estate Bubble Index

Dubai's real estate market may have been known for its volatility by some investors. After the 2008 financial crisis, the market experienced a crash, followed by a slow recovery from 2011 to 2014, and another correction afterward.

However, between 2020 and 2024, Dubai's property market has made a remarkable comeback, driven by key factors & backed by real demand without leverage or speculation including:

Foreign investment: Dubai's status as a global hub continues to attract substantial foreign capital.

Government initiatives: Policies such as long-term visas and freehold property ownership for foreign investors have stimulated market growth as well as D33 Agenda.

Expo 2020: The international event boosted confidence among developers and buyers, fueling renewed market activity.

Current Real Estate Bubble Index in Dubai

As of 2024, Dubai's Real Estate Bubble Index stands at approximately 0.64, indicating a moderate risk of a bubble. While the market is growing, factors such as a diversified economy, stricter regulations, and rising demand for luxury properties have helped mitigate bubble risks. Moreover, the Dubai Land Department (responsible for regulating and overseeing Dubai’s real estate sector) plays a crucial role in managing bubble risks by strictly controlling building permits to prevent oversupply, enforcing regulations for developers, and effectively managing overall supply and demand.

How a Rising Bubble Index Isn’t Bad News for Dubai

Though Dubai’s real estate bubble risk has increased, it isn't necessarily bad for the market for several reasons. A moderate increase in bubble risk can be a sign of a thriving economy, growing demand, and investor confidence. Here's why Dubai's situation isn't as alarming as it may seem:

1. Strong Economic Fundamentals: Dubai’s real estate prices are supported by strong economic fundamentals, including diversification into sectors like tourism, finance, and technology. Policies like free zones, foreign ownership rights, and favorable tax laws such as NO INCOME TAX & LOW CORPORATE TAX attract global businesses, driving real demand rather than speculation.

2. Infrastructure and Development Growth: Dubai’s continuous infrastructure development, including the expansion of the Metro and new residential projects, boosts property demand. Events like Expo 2020 and the city's goal to become a global tourism hub further attract both residents and investors, driving organic price growth.

3. Attractiveness to Foreign Investors: Dubai’s strategic location, political stability, and long-term visa policies make it attractive to foreign investors. While foreign demand increases bubble risk, it diversifies the market, reducing dependence on local buyers and making it less vulnerable to internal economic shifts.

4. Controlled Regulation to Avoid Overheating: The government has implemented mortgage caps, transaction monitoring, and oversupply management regulations to prevent a speculative bubble. These measures ensure price growth is sustainable and not purely driven by speculation, creating a more stable market!

5. Growth in the Luxury Sector: Dubai’s real estate growth is largely driven by luxury properties, attracting wealthy international buyers who hold investments longer. This sector’s growth signifies demand from high-net-worth individuals, adding stability and reducing the risk of a market crash.

6. Diversified Buyer Base: Dubai benefits from a global pool of buyers from Europe, Asia, and the Middle East, spreading market risk. This diversified demand ensures that if one segment weakens, others can provide stability, reinforcing Dubai’s position as a global real estate hub.

7. Tourism and Expat Demand: The city’s growing expat population and strong tourism industry create ongoing demand for both long-term and short-term properties. This steady demand bolsters the real estate market and supports sustained growth in the residential and rental sectors.

How Dubai Compares to Other Global Real Estate Hubs

1. No Taxes & Tax-Free Residency

Dubai: Dubai offers a tax-free environment with no income, capital gains, or property taxes, making it highly attractive for investors and residents alike. The absence of taxes maximizes net returns, allowing property owners to retain more of their earnings. Additionally, Dubai provides tax-free residency, an appealing benefit for expatriates.

Other Cities: Cities like New York, Paris, and Sydney impose high income taxes, capital gains, and property taxes or property acquisition cost, significantly reducing net returns on real estate investments. Taxation on residency and property purchases makes these cities less appealing from a profit-maximizing perspective.

2. 10-Year Golden Visa

Dubai: Investors who purchase property in Dubai can benefit from the 10-year Golden Visa, offering long-term residency with minimal requirements. This visa provides security for investors and their families, ensuring continued residence and property ownership.

Other Cities: While many European cities like Lisbon and Athens offer residency through investment, Dubai’s 10-year Golden Visa stands out for its simplicity and fewer financial requirements. Cities like Singapore or Zurich offer similar investment visas but often come with higher thresholds and more complex application processes.

3. Ease of Doing Business

Dubai: Establishing an LLC in Dubai is straightforward, especially in the UAE’s free zones, where 100% foreign ownership is allowed. Dubai consistently ranks high for ease of doing business, with supportive regulations, streamlined processes, and low operational costs.

Other Cities: In cities like Tokyo and Berlin, business regulations are more bureaucratic and complex, involving multiple steps for foreign entrepreneurs. Additionally, higher taxes and stricter legal frameworks in cities such as Toronto make setting up businesses more cumbersome.

4. Ease of Opening Bank Accounts for Non-Residents

Dubai: Non-residents in Dubai can easily open bank accounts, particularly property owners and business investors. The process is efficient, and banks cater to expatriates, offering a range of investment-friendly options.

Other Cities: In cities like Frankfurt and Paris, opening a bank account as a non-resident is more challenging, with stricter regulations, longer waiting periods, and stringent documentation requirements, making the process cumbersome for foreign investors.

5. Lower Price per Square Foot

Dubai: Compared to global cities, Dubai offers significantly lower property prices per square foot, even in high-end areas. This makes luxury real estate far more affordable to foreign investors and offers better value for money.

Other Cities: In cities like Hong Kong, London, and Tokyo, real estate prices are among the highest in the world, limiting opportunities for medium-scale investors. High costs often restrict investors to smaller properties or less desirable locations.

6. High Capital Appreciation in Off-Plan

Dubai: Off-plan properties in Dubai provide substantial capital appreciation, fueled by continuous development, infrastructure growth, and large-scale projects. Early investors in new developments see strong returns as the city expands.

Other Cities: In more established cities like New York, Melbourne, and Stockholm, capital appreciation in off-plan properties is typically lower due to market maturity and fewer new development zones.

7. High Rental ROI (8-10%)

Dubai: Dubai offers some of the highest rental returns globally, with rental yields up to 8-10% annually in long term rentals and 12-14% or more in short term rentals such as in AirBnB depending on the location, property specifications & seasons, especially in popular residential and commercial areas. This makes it highly attractive for buy-to-let investors.

Other Cities: Cities like Paris, London, and Tokyo provide much lower rental returns, often between 2-4% annually, due to higher property prices and slower demand growth in the rental market.

8. Strong Tourism Opportunities

Dubai: Dubai’s booming tourism sector, fueled by iconic attractions, luxury shopping, and global events, generates a steady demand for both short- and long-term rentals. This enhances the profitability of property investments.

Other Cities: Cities like Rome and Istanbul also thrive on tourism, but seasonal fluctuations and regulatory restrictions on short-term rentals reduce investment stability compared to Dubai’s year-round tourism-driven demand.

9. Short-Term Rental Business

Dubai: Short-term rentals, particularly through platforms like Airbnb, are flourishing in Dubai, with government backing and regulatory support for the sector. Property owners in key areas can maximize profits from the city’s strong demand for tourist accommodations.

Other Cities: Cities such as Barcelona and San Francisco have introduced strict regulations or considering outright bans on short-term rentals, limiting the potential for investors in these markets.

10. Buying Property with Cryptocurrency

Dubai: Dubai has embraced cryptocurrency in real estate, allowing property transactions through crypto. It offers a regulated market with no crypto taxes, providing a futuristic and flexible investment platform.

Other Cities: In places like London and New York, real estate purchases with cryptocurrency are rare, with unclear regulations and high taxation on crypto, making Dubai a leader in integrating digital currencies into property markets.

11. Escrow Account with Developer and Government

Dubai: The UAE mandates the use of escrow accounts for real estate transactions, ensuring that buyers' funds are protected. This system provides transparency and security, minimizing risks associated with off-plan purchases.

Other Cities: In cities like Mumbai and Bangkok, escrow accounts are not as prevalent or regulated, increasing the risk of delayed or failed projects, and making Dubai a safer market for off-plan property investors.

12. Safe and Secure Investment

Dubai: With a regulated real estate market, government-backed escrow accounts, and transparent processes, Dubai provides a secure investment environment for foreign nationals. Property investors benefit from legal protections and clear ownership rights.

Other Cities: Cities like Athens, Lisbon, and Bangkok may offer real estate opportunities, but they often come with more risks related to market fluctuations, legal complexities, and political uncertainty, making them less stable than Dubai.

Conclusion:

While Dubai's real estate market faces rising prices and a moderate increase in bubble risk, this trend isn't necessarily negative as it's backed by strong real demand with growth in other verticals such as population increase, economic growth etc. Strong economic fundamentals, effective regulatory measures, infrastructure growth, and a diverse international buyer base further enhance market resilience. As long as speculative demand is managed and government oversight continues, the rising bubble index could indicate healthy growth rather than an impending market crash.

Moreover, this period of growth represents an opportunity, particularly for investors looking to enter a high-demand, globally connected market. However, caution is still necessary to ensure long-term sustainability as not all projects can guarantee 100% returns which is why, it's extremely necessary to look at all factors when investing in Dubai.

Comments