How Dubai Protects Its Investors in Off-Plan Real Estate

- Hamza Alavi

- Oct 23, 2024

- 4 min read

Updated: Oct 29, 2025

When investing in properties in the UAE, safeguarding your funds is a top priority. To ensure investor protection and transparency, the UAE government mandates the use of escrow accounts for real estate projects. This detailed overview explores how the government’s escrow system works, why it’s crucial for protecting investor funds, and how it offers unique benefits to international investors looking to enter Dubai’s real estate market.

Understanding Escrow Accounts

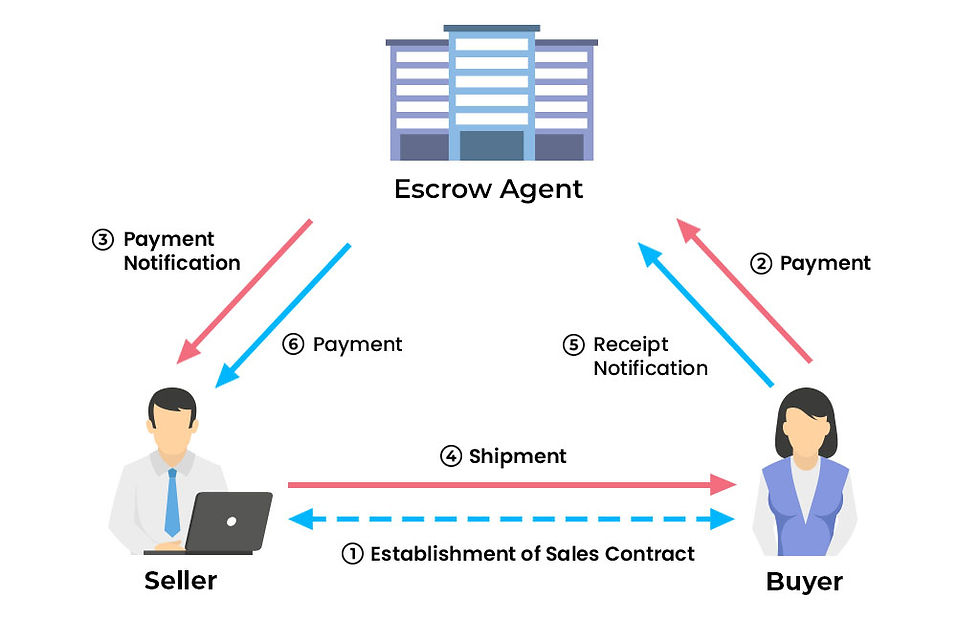

The word “Escrow” means to put funds or documents, such as deeds or bonds, in the custody of an authorized third party such as a Governmental or Financial Institution until certain conditions between buyers & sellers are met after which the funds will be transferred.

How Do Escrow Accounts Works:

An escrow account is a financial arrangement wherein a neutral third party holds and manages funds on behalf of two parties involved in a transaction. In the context of real estate in Dubai, when a buyer engages with a developer, the buyer's payments are deposited into a government-regulated escrow account. The escrow system is regulated by the Dubai Land Department (DLD) and the Real Estate Regulatory Authority (RERA) to safeguard buyer interests and to fund the specific real estate project.

Simply, an escrow account in Dubai is a secure bank account used during real estate transactions, specifically for off-plan properties, to protect buyers and ensure the proper use of funds by developers.

How it Works:

Buyer Payments: When purchasing an off-plan property, the buyer deposits payments into the escrow account rather than directly to the developer.

Developer Access: The developer can only access the funds in the escrow account once specific construction milestones are completed. This ensures that the developer uses the money exclusively for the project's development.

Escrow Manager: An independent escrow agent (usually a registered bank) manages the account and monitors the progress of the project to release funds accordingly.

Purpose:

The escrow system minimizes the risk for buyers by preventing developers from using funds for anything other than the intended construction, ensuring project completion and financial accountability.

This mechanism is mandatory for developers selling off-plan properties, providing confidence to investors and contributing to Dubai’s overall real estate market stability.

Key Features of Escrow Accounts

Regulatory Oversight: The Dubai government regulates the escrow system, ensuring compliance with laws and guidelines established to protect the rights of both buyers and developers. According to the DLD, escrow accounts are mandatory for all off-plan property sales, ensuring that developers adhere to financial discipline and transparency.

Project-Specific Funds: Funds deposited in the escrow account can only be released to the developer in accordance with the project's construction milestones. This means that developers receive payments only when specific phases of construction are completed, protecting buyers from the risk of paying upfront for projects that may not materialize.

Security for Buyers: This arrangement provides an added layer of security for buyers, assuring them that their funds will only be used for their intended purpose—the completion of the property. According to a report by Property Finder, approximately 67% of off-plan property transactions in Dubai utilize escrow accounts, reflecting their increasing importance in safeguarding investments.

Benefits for Investors, Foreign Nationals, and Expatriates

Reduced Risk of Fraud: The use of escrow accounts significantly diminishes the risk of fraudulent activities. Investors can be confident that their funds are secured within a government-regulated account and are not misappropriated by developers. This regulatory framework makes Dubai a trustworthy market for foreign investors.

Transparency in Transactions: Escrow accounts provide transparency in the flow of funds. Investors can monitor their payments and ensure they are in line with the project's progress. This transparency fosters a trusting relationship between buyers and developers.

Milestone-Based Payments: Investors can take comfort in knowing that their payments are structured around specific construction milestones. This means they only pay as the project advances, aligning their financial commitments with tangible progress. For example, an investor might pay 20% upon contract signing, 30% upon completion of the foundation, and so on. This structured payment plan minimizes the risk of financial loss, making it easier for investors to manage their cash flow.

Legal Protection: The escrow account system is backed by the laws of Dubai, providing legal recourse for investors in the event of disputes. Buyers can take comfort in knowing that there are legal frameworks in place to protect their interests.

Investment Confidence: Knowing that funds are held securely in a government-regulated escrow account enhances investor confidence. This assurance attracts more foreign nationals and expatriates to Dubai’s real estate market, contributing to the overall growth of the sector.

Real World Impact & Impact

The introduction of the escrow account system has played a pivotal role in the resurgence of Dubai's real estate market. In 2023, property transactions in Dubai reached approximately AED 300 billion, with a significant proportion involving off-plan sales. The implementation of escrow accounts has been instrumental in building investor trust, as evidenced by a 35% increase in off-plan property sales compared to the previous year.

Moreover, the Dubai Land Department reported that over 80% of developers in Dubai comply with the escrow account regulations, demonstrating a commitment to maintaining financial integrity within the sector. This compliance not only protects investors but also promotes a stable and attractive investment environment.

How Dubai's Free Zones Benefit from the Escrow System

For investors eyeing Dubai’s free zones, the escrow system plays an equally important role. Free zones have seen significant off-plan investments, with the escrow account system ensuring that development timelines are met and that foreign investors receive their promised returns. The free zone developments, coupled with the protections offered by escrow accounts, create an environment where foreign nationals and expatriates can invest confidently, knowing their capital is safe.

Conclusion: Why Dubai’s Escrow System is a Game-Changer for Investors

Dubai’s government escrow account system is one of the most secure and transparent real estate protections available to investors. By ensuring that payments are tied to specific milestones and offering government oversight, this system eliminates much of the risk associated with off-plan property investments.

For investors looking to tap into Dubai’s growing real estate market, the escrow account system offers a layer of financial security that is rarely found in other global markets. Investing in Dubai’s off-plan properties, backed by the security of an escrow account, offers not just an opportunity for growth but a secure pathway to building wealth in one of the world’s most dynamic property markets.

Comments